Unlocking Vietnam’s Carbon Market Potential: A Step Towards a Low-Carbon Economy

Vietnam is taking bold steps toward developing a robust carbon market, aligning with its commitment to reducing greenhouse gas emissions and achieving net-zero emissions by 2050. With the government’s plan to pilot a domestic carbon credit exchange from 2026 to 2028 and transition to full-scale operations by 2029, this market will serve as a vital mechanism for businesses to comply with environmental regulations while unlocking new financial opportunities.

Vietnam’s Carbon Market: A Strategic Move Towards Net-Zero

Vietnam has set ambitious climate targets, including a commitment to achieving net-zero carbon emissions by 2050. To achieve this, the government has approved a comprehensive roadmap for establishing a domestic carbon market, with pilot trading scheduled to begin in June 2028 and full operations commencing in 2029.

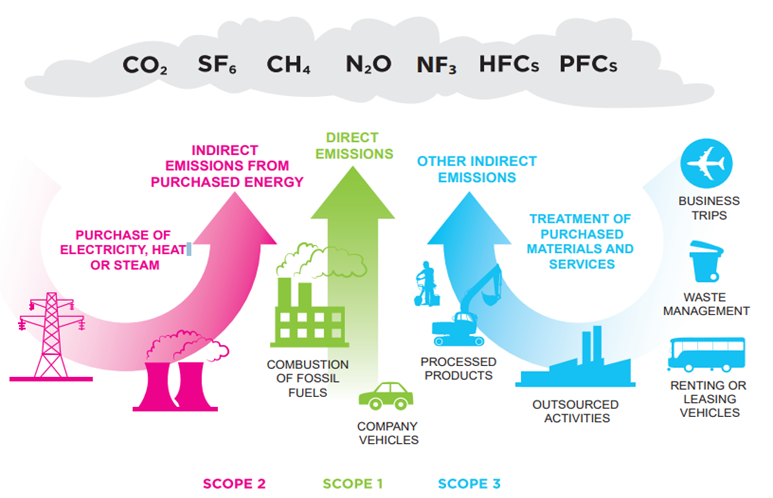

The carbon market is poised to become an essential tool for businesses to manage and mitigate greenhouse gas (GHG) emissions efficiently. By enabling enterprises to trade carbon credits, this system creates financial incentives for emission reduction while ensuring alignment with international sustainability standards.

Key Developments and Regulatory Framework

To establish a structured and transparent carbon market, the Ministry of Natural Resources and Environment (MONRE), in collaboration with key government agencies, is formulating regulations to govern carbon credit trading. Key developments include:

? Emission Quotas & Carbon Credit Trading Framework:

- By 2025, Vietnam will finalize the total allowable emissions quota for the period leading up to 2030. Enterprises exceeding their allocated limits will be required to purchase carbon credits or offset emissions through approved sustainability projects.

- The government is actively reviewing policies for international credit transfers to ensure seamless integration with global markets.

? Carbon Market Participation & Management:

- Over 2,166 facilities across six major industries (energy, transport, construction, industrial processes, agriculture & land use, and waste management) are mandated to conduct GHG inventories.

- The list of entities subject to GHG emission reporting and reduction obligations will be updated biennially to reflect market evolution and regulatory advancements.

? National Carbon Exchange Platform:

- Vietnam is set to establish a national carbon credit trading platform, managed by the Vietnam Stock Exchange, ensuring a centralized, efficient, and transparent trading environment.

- Financial regulations, including tax and fee structures for carbon trading, are being reviewed to support market efficiency and fairness.

Business Opportunities in Vietnam’s Carbon Market

The development of a structured domestic carbon market presents transformative opportunities for businesses across industries:

? Cost Savings & Revenue Generation:

- Companies investing in emission reduction initiatives can monetize excess carbon credits, turning sustainability efforts into direct financial gains.

♻️ Regulatory Compliance:

- Proactively reducing emissions will position businesses ahead of regulatory mandates, mitigating risks of non-compliance and potential financial penalties.

? Enhanced Global Competitiveness:

- Enterprises integrating carbon credit mechanisms will gain a competitive edge in international markets, particularly with sustainability-focused global partners and investors.

? Attracting Investment:

- A well-regulated carbon market underscores Vietnam’s commitment to green finance, enhancing its appeal to foreign direct investments in renewable energy, carbon offset initiatives, and sustainability-driven enterprises.

Challenges & Market Readiness

Despite its immense potential, Vietnam’s carbon market faces several challenges that must be addressed for successful implementation:

- ?️ Lack of Awareness & Expertise: Many businesses remain unfamiliar with carbon credit mechanisms and emissions trading systems.

- ?️ Regulatory Complexity: Navigating an evolving regulatory landscape can be challenging for businesses lacking environmental compliance expertise.

- ?️ Market Readiness: Transitioning from voluntary participation to mandatory carbon trading requires substantial capacity-building efforts and policy refinement.

The Role of ASEAN Carbon Credit Trading Platform (CCTPA)

As Vietnam’s first voluntary carbon credit trading platform, the ASEAN Carbon Credit Trading Platform JSC (CCTPA) is at the forefront of guiding businesses through this emerging market. Established by CT Group and launched on September 29, 2023, CCTPA is dedicated to promoting a low-carbon economy and supporting enterprises in adapting to international environmental trade policies.

By providing transparent and efficient trading solutions, CCTPA empowers businesses to:

- Navigate the complexities of carbon credit trading.

- Access reliable market data and regulatory insights.

- Leverage carbon finance to accelerate decarbonization strategies and enhance sustainability efforts.

Conclusion

Vietnam’s carbon market is set to become a transformative force in the country’s shift toward a low-carbon economy. Businesses that proactively engage with this market will gain significant advantages, including cost savings, regulatory compliance, and global competitiveness.

As a leader in carbon credit trading, CCTPA is committed to supporting Vietnamese enterprises in their sustainability transition, ensuring that they are well-positioned to capitalize on the opportunities presented by this dynamic and rapidly evolving market.