Reducing carbon emissions is one of the most critical issues facing individuals and governments today. This is evident through a focus on ESG investing while governments create a cost through carbon credits to account for climate impact.

ESG stands for Environmental, Social and Governance. Within investing, it refers to investors considering these factors in companies they invest in.

Many ESG investors place significant focus on the environmental component and opt to get rid of environmental polluters from their portfolio.

Instead, they choose to invest in businesses working to cut dependence on fossil fuels.

In the meantime, governments limit carbon emissions of firms through carbon credits. But these credits can also be used as a source of revenue.

So, what are carbon credits and how do they become the new currency of ESG investing to meet environmental regulation?

This article will answer this question by explaining ESG investing and what role carbon credits have in this investment realm.

The Changing Environment of ESG Investing

It’s now widely recognized that non-financial factors can inform investors about business performance. And so, there’s growing interest in the significance of ESG topics in the investment world.

Also, businesses today are impacted by climate change, disrupting operations and supply chains. More notably, climate change also affects markets and demands.

As a result, markets are adapting to climate change and every business has to respond to it. Otherwise, it becomes both an operational and commercial risk.

- So investors have a role to play in ensuring that companies manage climate risks responsibly.

This change is impacting investment strategy as investors shift from risk aware investments to opportunity aware investments.

More and more of them are looking to invest in sectors that benefit from climate change. And most notably, the majority of them show an interest in putting their money in sustainability-focused strategies.

The sustainability boom resulted in trillions of dollars through ESG funds.

- Businesses can leverage this changing trend by showing a robust climate strategy through their ESG reports.

This change is quite new, but it becomes mainstream so quickly. This could be due to evidence that climate-aware investing strategies like ESG produce good results.

The evolution of ESG mirrors the change in how people perceive climate change, too.

In recent years, ESG policies moved from a simple principle of doing no harm to having a positive impact on the company’s bottom line.

Add to this the increasing need for transparent and robust ESG reporting. This is driven by regulation such as the case of the Green Deal as the EU’s reporting directive.

Firms that adhere to reporting requirements tend to gain good sustainability ratings. In turn, their investment results tend to be also higher than companies with weak reporting standards and poor ratings.

But policy aside, stakeholders are also putting greater pressure on companies to get more information on their ESG performance.

This further prompts firms to have more robust ESG strategies. They communicate these to their employees, investors, and customers.

Finally, securing sustainable funding is another key factor that drives companies to differentiate themselves via ESG investing.

- Investors are now favoring ESG performance as a proxy for good management.

In fact, the big four firms – PwC, Deloitte, EY, and KPMG – hope that ESG is key to rebuilding consumer trust after many scandals and multi-million-dollar payouts.

Hence, companies that can demonstrate strength on ESG may secure better financial support and results.

And this changing landscape in ESG investing will increase as ESG becomes more integral to businesses. But what role do carbon credits have in the space of ESG investing?

What Do Carbon Credits Mean in ESG Investing

The Carbon Credit Standard

In the U.S., the coin of the realm is US dollars, in the EU, it’s euro. In the ESG world, it’s the carbon credit – a unit representing 1 tonne of CO2 removed/avoided.

A carbon credit is a permit that allows its owner to emit a certain amount of CO2 or other GHG. In the voluntary carbon markets, carbon credits are known as carbon offsets.

Carbon offsets occupy a relatively small space on the ESG realm. But as more countries and companies pledge to reach net zero, carbon credits are gaining more attention in ESG investing to hasten carbon reductions.

In fact, growing demand has fueled record-high prices in some markets.

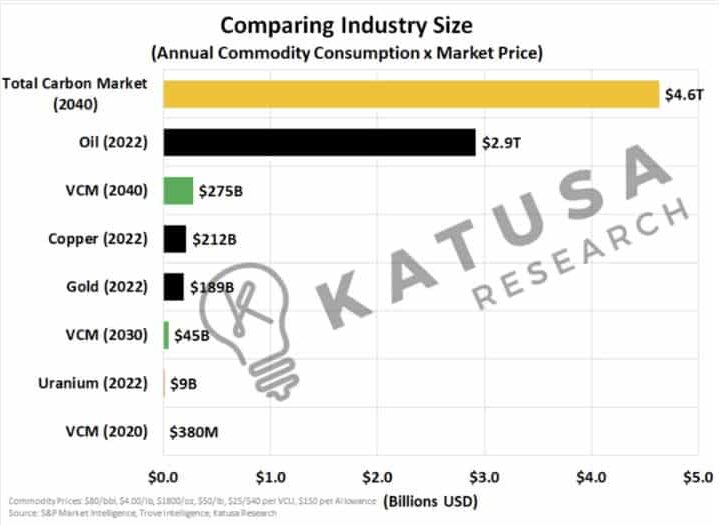

But why should investors care? Because the carbon credit market is growing exponentially.

- Carbon credits grew by a whopping 164% in 2021 with a notional value of $851 billion. And market projections are even more eye-popping.

Research firms forecast ranges that the market will grow as much as 30X more by 2030 and 100X more by 2050.

If these estimates are correct, the carbon credit market will be equal in size to the NASDAQ stock market by 2030.

According to the independent firm Katusa Research, the total carbon market (compliance and voluntary) could be as big as the oil market…

Source: Katusa Research

Entities have been relying on carbon credits to avoid or reduce their emissions.

Companies regulated under the “cap-and-trade” program (compliance carbon market) have no choice but to buy credits if they go beyond their emissions limit (cap).

For those who’re offsetting their emissions voluntarily, they can buy carbon credits from various projects. The most popular ones are nature-based projects like afforestation and tree-planting.

Markets and rules are beginning to blend

Carbon credits are still evolving as a distinct asset class. But carbon markets are starting to take better form as regulators and industry groups help codify rules around them.

In fact, various initiatives and regulations emerge to guide ESG investors in their investment decisions. The same goes for carbon standards and verification bodies.

They’re becoming more stringent to ensure the quality and integrity of the credits buyers and investors pick.

Guidelines and growing investor awareness are helping carbon credits gain traction.

In the US, proposed SEC disclosure rules around climate change impacts mandates carbon credits accounting and reporting. This is a big step to promote transparency in the space.

Investors more aware of credits role in ESG

As the emphasis on corporate climate pledges grows, investors’ interest in carbon credits also intensifies.

Activism around ESG will grow even more in the next few years as the world fights global warming.

In the “E” factor, more investors are now becoming aware of how carbon credits can directly impact a company’s cash flow, reputation, and other standing.

So, when reports showed that 100 global companies are accountable for 71% of total emissions, ESG investors have greater reason to push for carbon reduction measures.

As such, we can expect that trading carbon offsets to rise even more.

Here are the reasons why carbon credits matter a lot in ESG investing.

Evaluating carbon credits: Some key factors to consider

Projects that produce carbon credits vary. So, ESG investors have to assess them well to know which ones to choose.

Local stakeholders will more likely favor carbon reduction projects with local co-benefits like job creation and biodiversity. However, these credits tend to cost more but they carry less risk and may offer more permanence.

There are certain metrics to consider to select quality offsets. These include additionality, permanence, measurability, and scalability.

It may take some time before carbon credits to become key asset allocation options for the average investor. But more transparency, better pricing, and market standards gave the offsets some spotlight they deserve.

When implemented correctly, offsets play an important supporting role in the fight against global warming. This is especially true when reducing carbon emissions is a battle of increments, not an overnight fix.

We believe they’re worth actively exploring within a broader ESG-investing context. Their global abundance can especially encourage flows of capital to stakeholders in developing countries and help facilitate broader attainment of SDGs.

How Companies Can Benefit from ESG Investing with Carbon Credits?

The strong emphasis on the “E” factor in ESG investing has never been greater. The world has been experiencing extreme weather conditions such as floods, drought, and heat waves.

Climate change has also been impacting every sector of the economy. Every business has to bear the environmental impacts associated with their operations.

So to limit the speed of global warming, companies are pledging to cut down their carbon emissions. More firms commit to reaching net zero emissions by 2050 or earlier.

This is where leveraging carbon credits as the currency of ESG investing puts a company at an advantaged position.

By investing in projects that reduce GHG emissions or avoiding reliance on fossil fuels, carbon credits are created. Firms with excess credits can sell them to other companies that fail to meet their carbon reduction targets.

This will bring in more measurable incentive for companies to make contributions in fighting climate change.

And more remarkably, ESG investors prefer to place their money on greener business models.

Carbon credits represent a certain amount of GHG emissions reduced or avoided.

That means where carbon credits are linked to, investors are also more likely to follow with their money. Popular examples include using renewables, adopting cleaner technologies, and energy-efficient investments.

Carbon credits are now commonly traded and they’re not only by businesses. Some investors are trading carbon credits in a similar way to physical commodities.

But ESG investors need to ensure that carbon credits are indeed reducing emissions as they claim to be. Once this is verified, companies will realize that ESG investing with carbon credits is all worth it.

Source: carboncredits.com